Why Biz mPOS?

Running business on the go, the terminal machine is inconvenient to bring?

Not accepting credit/debit card because getting a terminal machine is expensive and troublesome?

Maintaining another machine and bank account are just not ideal for your business model?

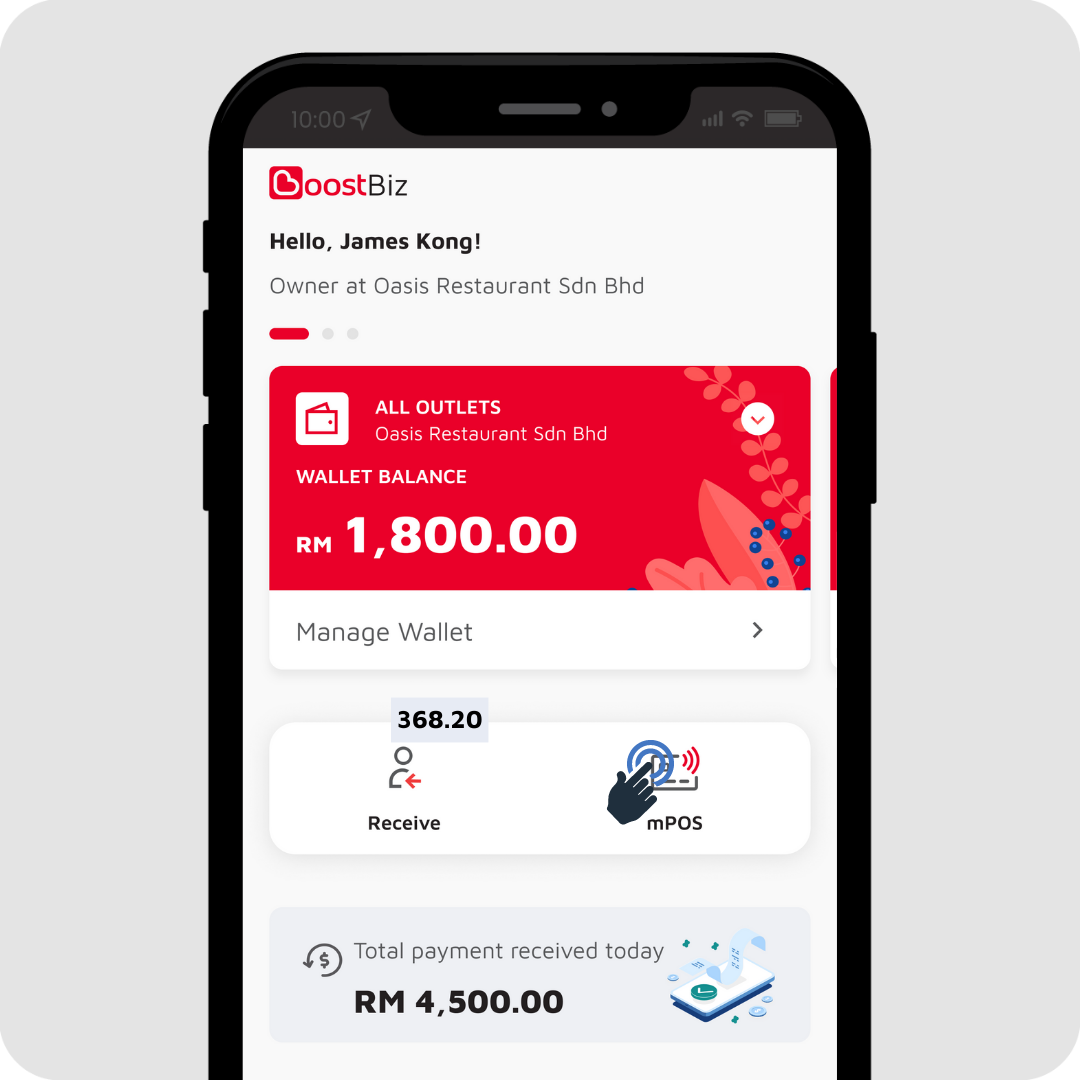

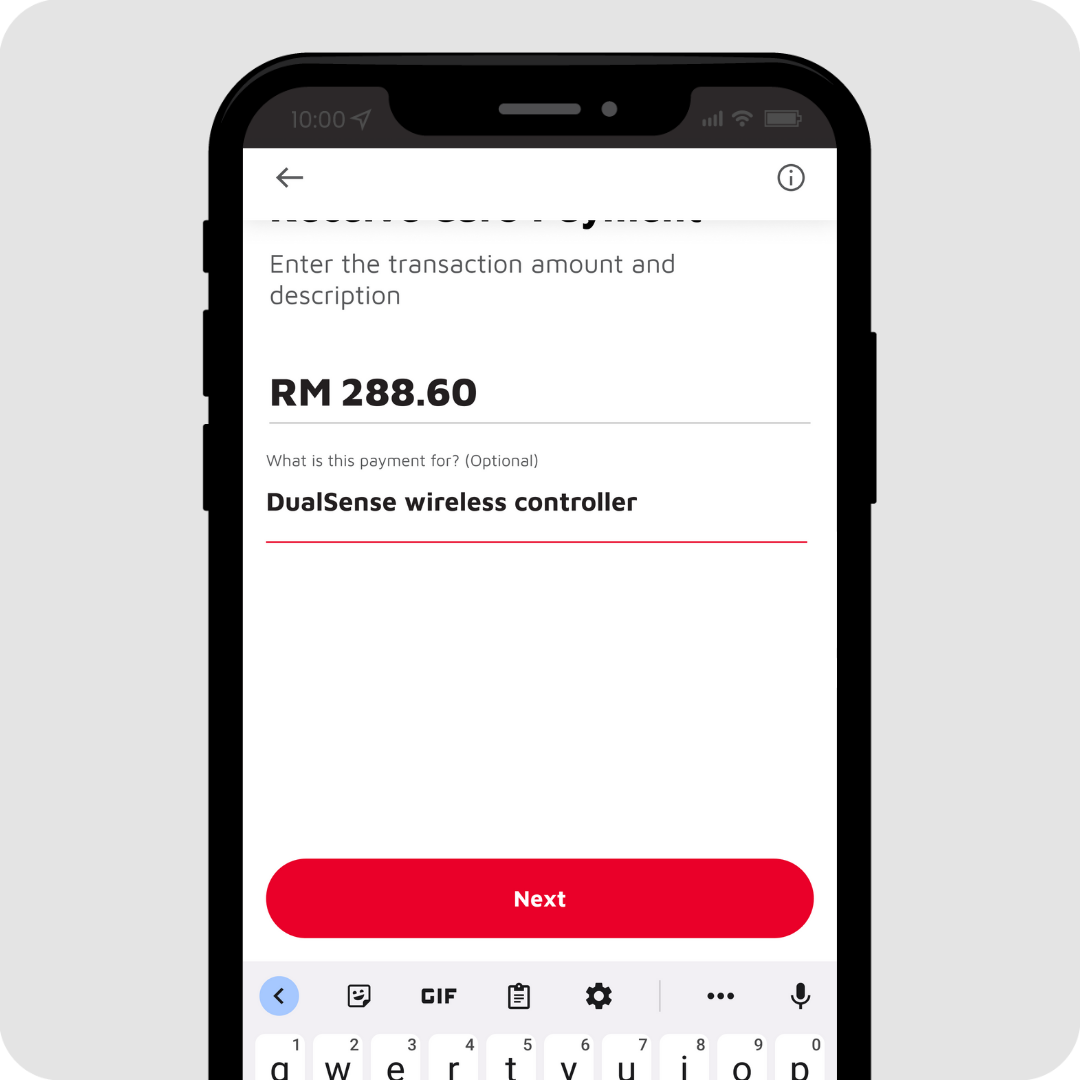

With Biz mPOS, customers just need to tap their credit/debit cards on your smartphones and the payments will be completed.

Easy, right?

Key Features

Accept Payments On The Go

Receive payments wherever you are, with only a smartphone.

No Contract, No Commitment

Subscribe or cancel any time with no worries about hitting your sales target.

Credit and Debit Card Acceptance

Safely accept Visa, Mastercard and UnionPay, both local and international cards.

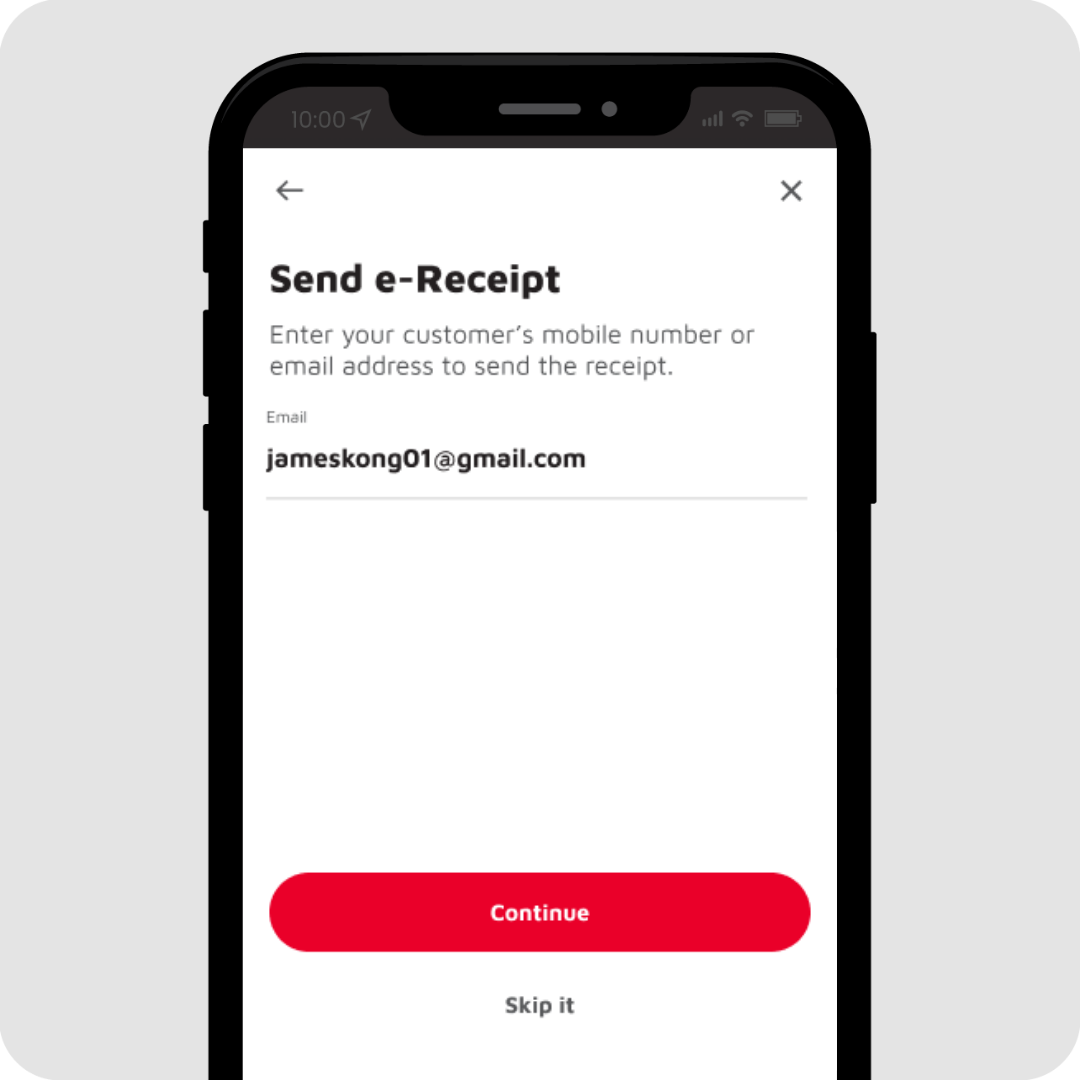

Friendly To The Environment

Reduce receipt printing. Send e-receipts to your customers via email or SMS.

Wondering If This is For You?

Travelling to client's place to provide service?

Whether you're a technician or a beauty service provider working from home, Biz mPOS makes it easier for you to take care of your clients by offering them different payment options on the go!

Business on mobile trucks or pop-up stalls?

Don't lose your customers due to limited payment methods. Accept card payments just with your smartphone!

Bring it with you anywhere you go.

Too expensive to rent a terminal device?

Want to accept credit/debit card payment but getting a terminal machine is not an affordable solution for you? Opt for Biz mPOS with no commitment and a low subscription fee.

As Low As RM15 Per Month

4 Steps to Accept Card Payment on Your Smartphone

*available for Android phones with NFC

Contact Us

Reach out to us for more details

Tutorial Videos

We'll guide you step by step

Know More

In BoostBiz app, tap on the mPOS tile and follow the steps to complete

the onboarding process.

1. BoostBiz app

2. An Android phone

3. Internet Connection

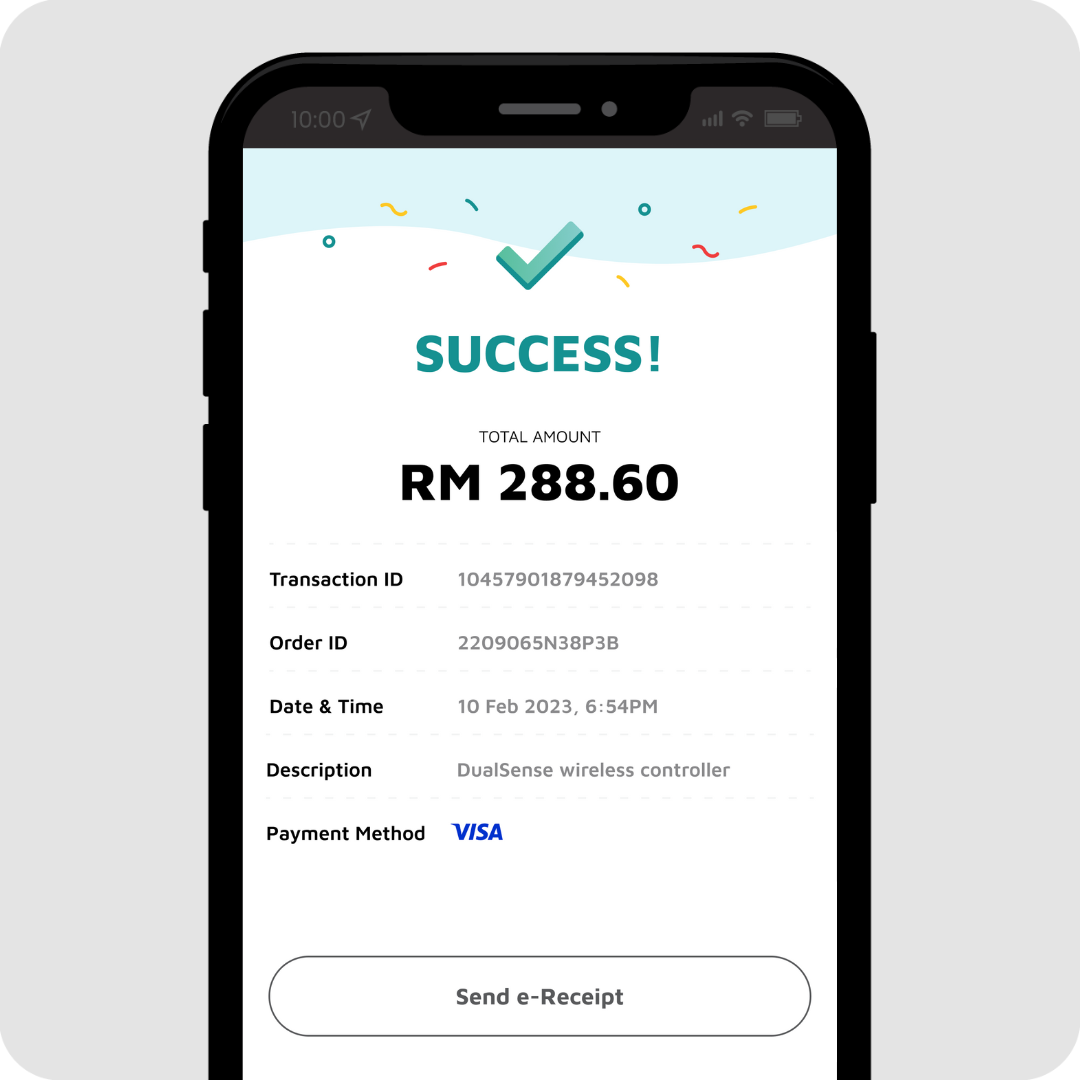

The transaction charges are as below:

Credit Card - 1.3%

Debit Card - 0.8%

Foreign Credit & Debit Card - 3.0%

For all successful transactions, the payment will be deposited to the bank

account provided by you.

The settlement takes only 2 working days.

You can view the settlement reports on GKash merchant portal. You will

be provided with the login credentials once your application is approved.

Yes, you can cancel/void a transaction on Gkash merchant portal. This

shall be done before the settlement period (by 11:45pm on the same

day).

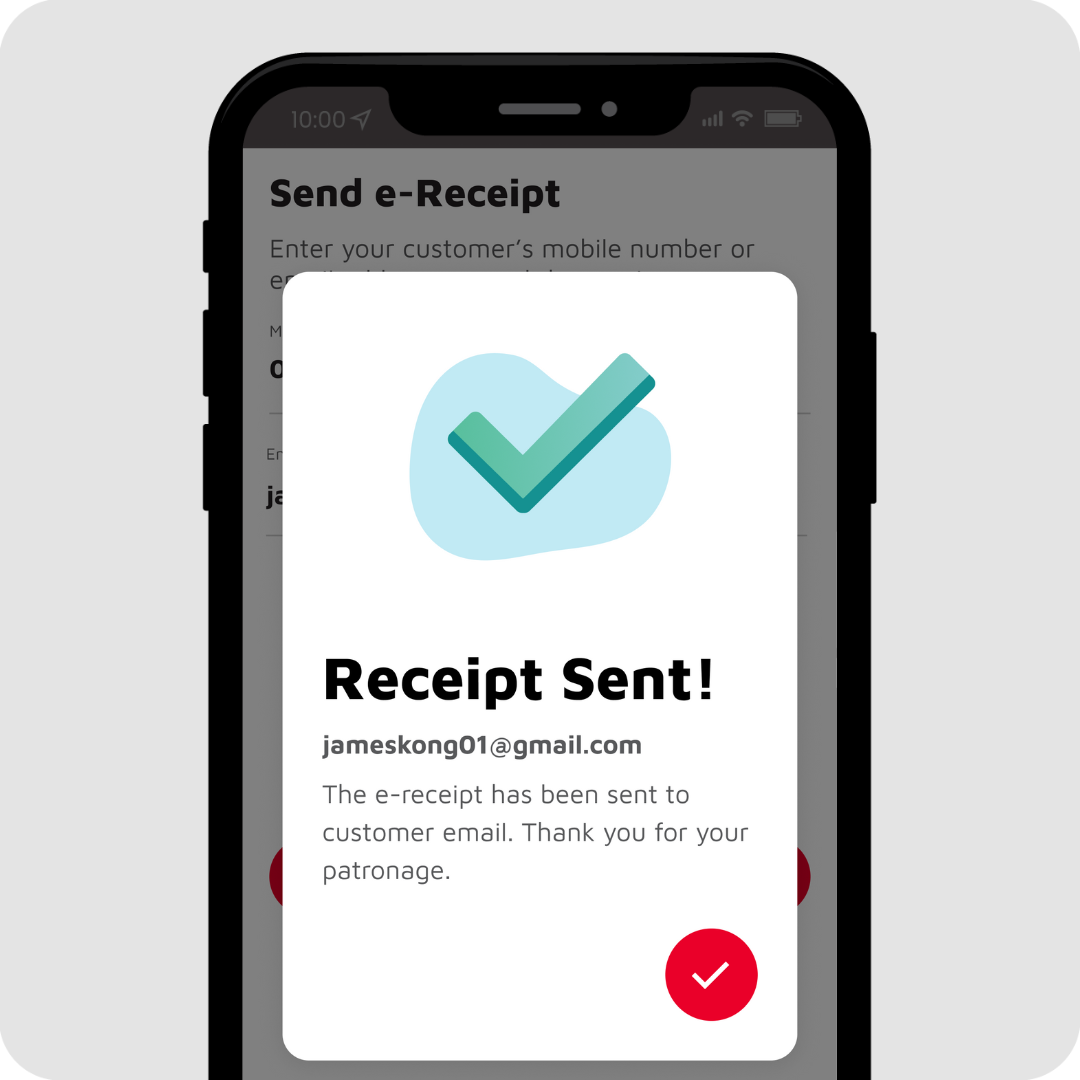

Yes, you can send e-receipt to your customer via email and/or SMS.