No More Waiting! Receive Instant Settlement when Your Customer Pays

Do More with Biz Merchant Wallet

Why wait when you can receive money instantly when a customer makes payment? Use the money to pay your suppliers and utility bills in just a few clicks away! All these and more with the new Boost Biz Merchant Wallet.

Scroll to learn more!

Key Benefits

Instant Settlement

Receive money instantly into your Biz Merchant Wallet when a customer makes payment.

Instant Scan & Pay

Scan and pay your suppliers or vendors via Boost DuitNow QR.

Instant Bill Payment

Pay for utility bills and set recurring bill payment, all at your fingertips!

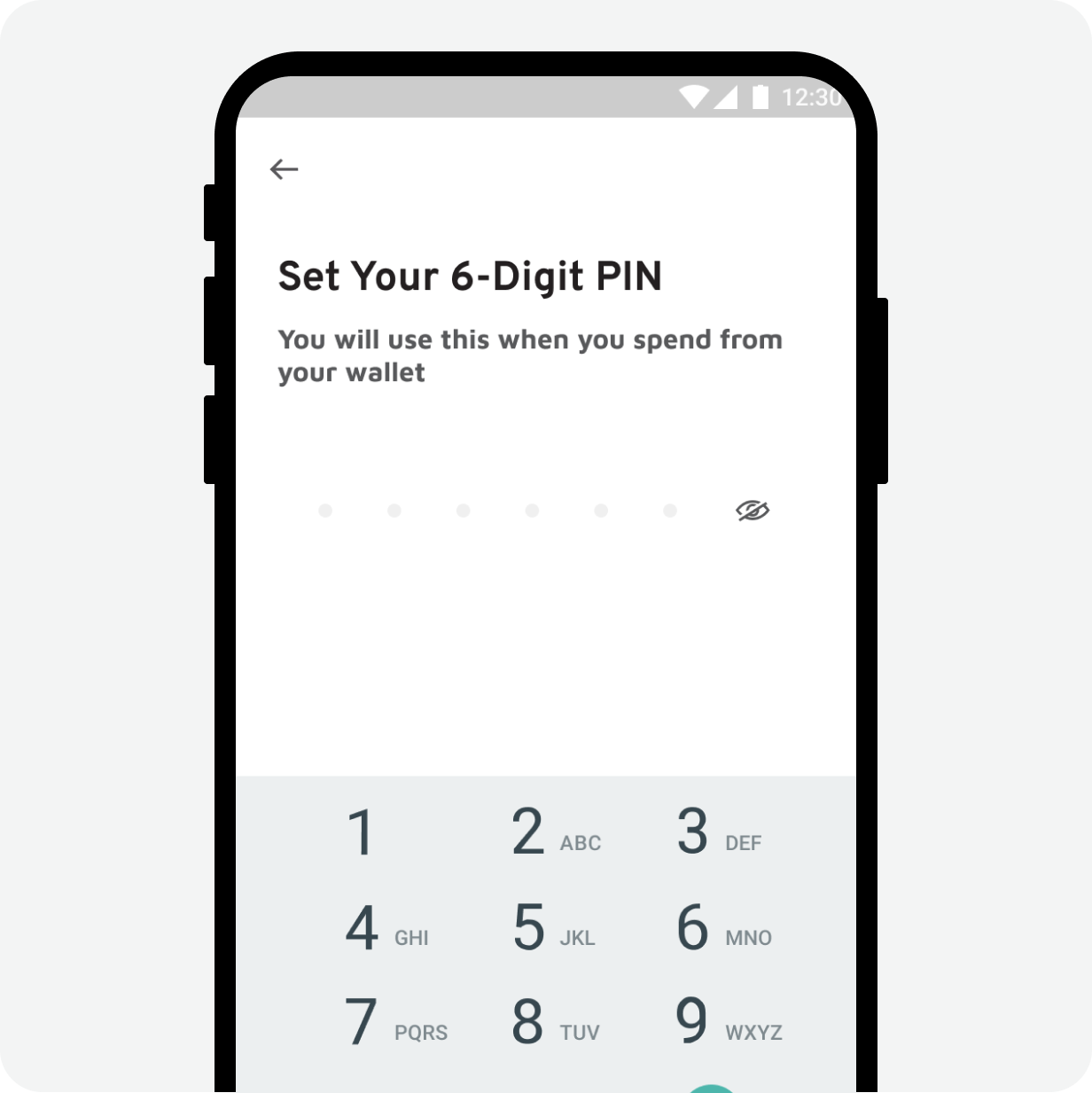

It’s easy to set up a Biz Merchant Wallet!

Follow these five simple steps to boost up your business!

Meet Our Merchants

Know More

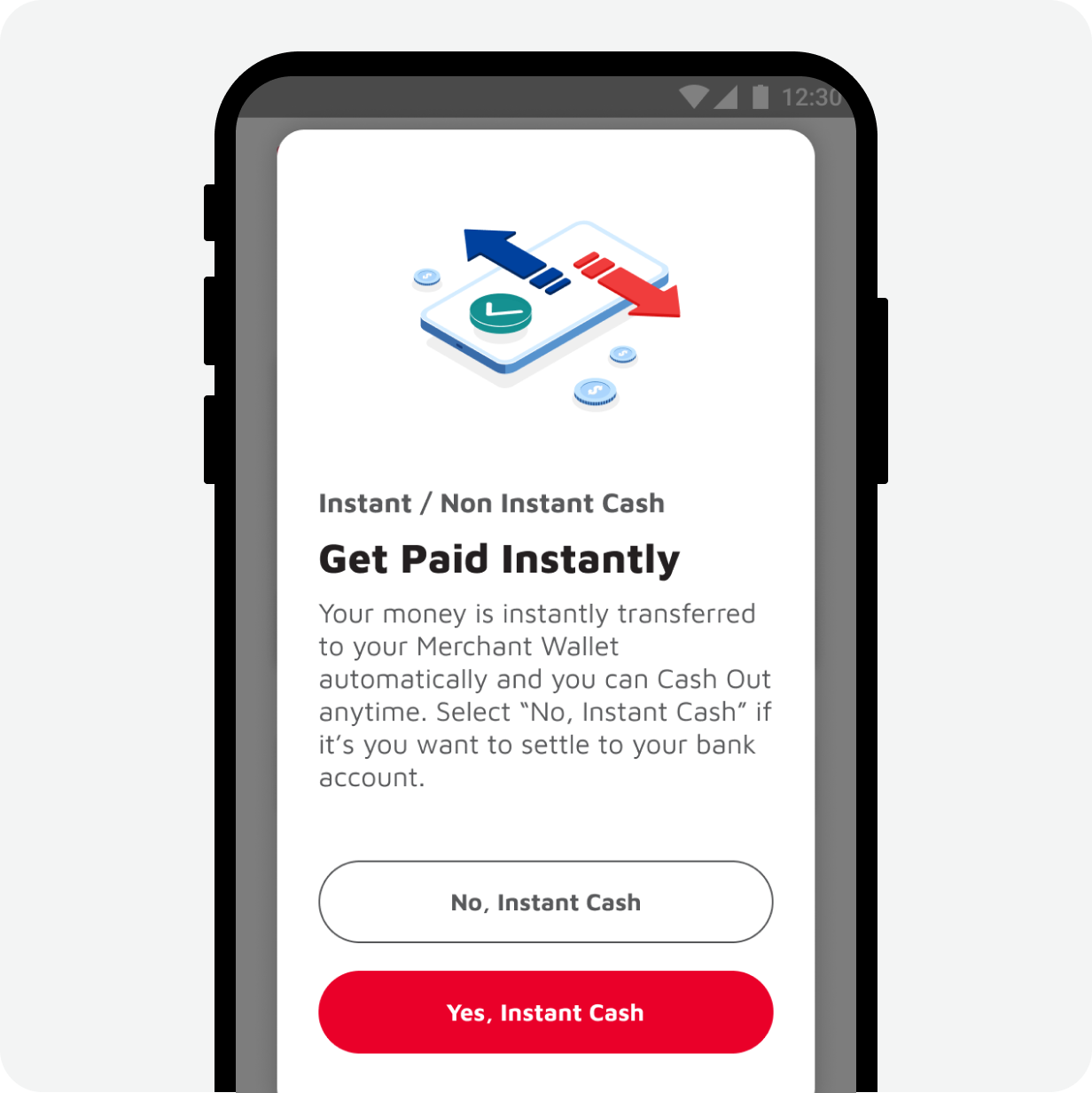

Boost Biz Merchant Wallet allows merchants to receive payment instantly and make payment from their Boost Biz App.

With Merchant Wallet, you are able to utilise the money received from your business instantly instead of waiting for T + 1 day to your bank account. To ease your business process, you can also pay your utility and water bills or other business purchases, all in Boost Biz App.

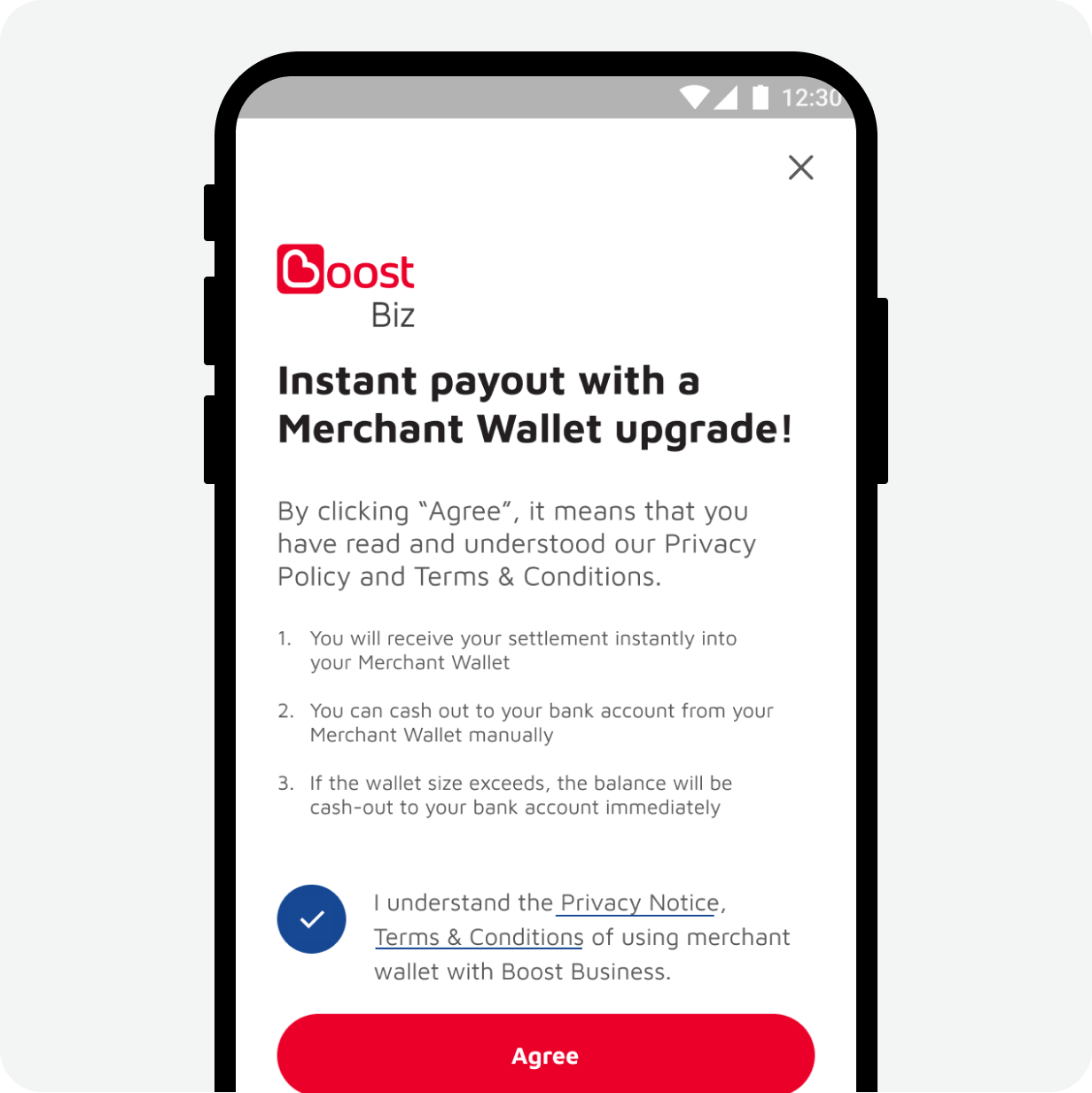

Sign up as a Boost Biz merchant here. Once you are approved as a Boost Biz merchant, you will get to enjoy the convenience of Merchant Wallet after accepting the terms and conditions. For existing merchants, please update your Boost Biz app to the latest version and accept all the terms and conditions to activate Merchant Wallet.

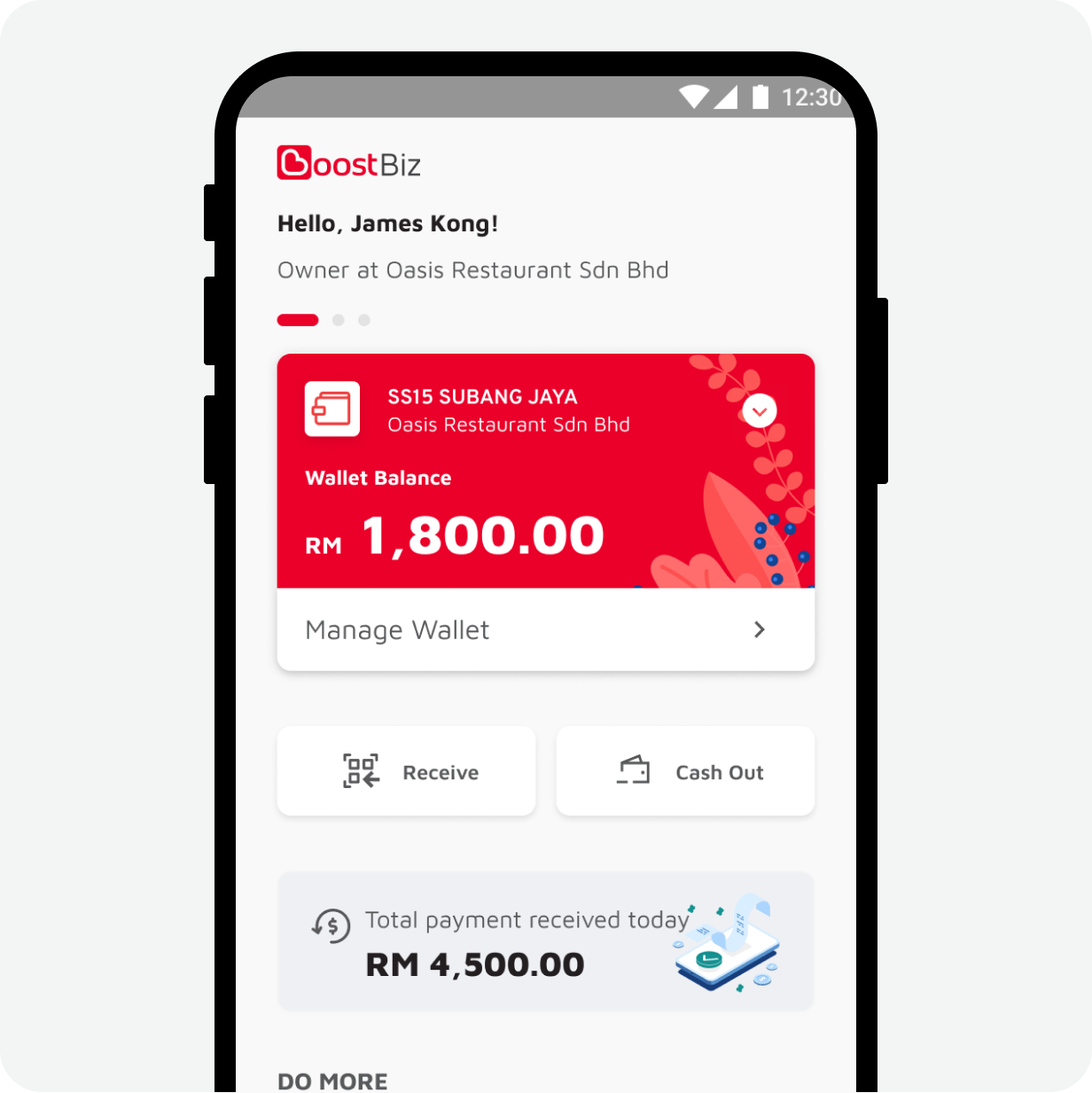

Go to Wallet/Manage Wallet > Cash Out. Enter the amount that you would like to withdraw. Upon confirmation, your cash out amount will be reflected in your settlement bank account in the next working day.

At your Boost Biz app/web portal, there is a card named “Payment Received Today” which reflects all the sales received into your Merchant Wallet.

Yes, there is an assigned wallet limit based on the approval from Bank Negara Malaysia, which are as below:

| Merchant Type | Individual Merchant | Direct Merchant |

| Wallet Size/Cash-in Limit | RM30,000 | RM500,000 |

| Monthly Transaction Limit | RM60,000 | RM500,000 |

| Annual Transaction Limit | RM720,000 | RM6,000,000 |

Any transaction received exceeds the wallet limit will be settled to the merchant bank account, which is the same as the current process of T + 1 working day.