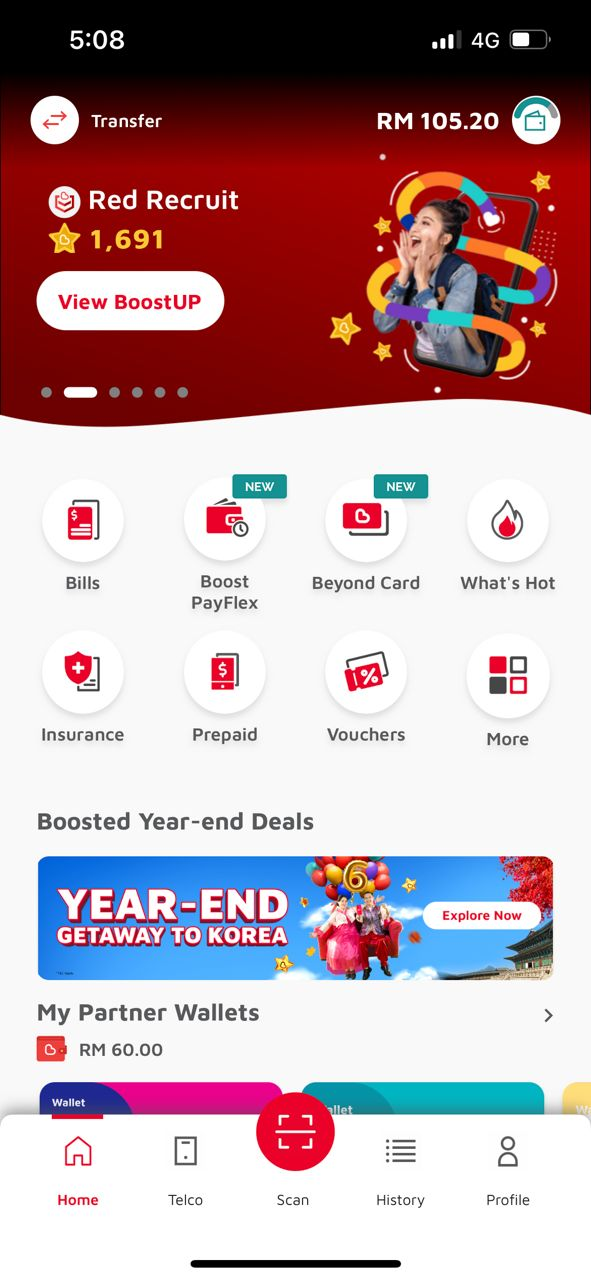

What is Boost PayFlex Service?

Boost PayFlex is here to help you obtain what you desire, when you desire it. Enjoy the flexibility to stretch your payments up to 6 months at over 1.8 mil DuitNow QR nationwide along with the ability to pay your bills and prepaid top up with our flexible finance plan. It's a stress-free way to enjoy life's pleasures, just get whatever you want now and pay Boost later. Experience the convenience of flexible payment plans today!

Where to Use Boost PayFlex

Experience the convenience of flexible and convenient payment options, empowering you to manage their transactions according to your preferences and needs.

Scan & Pay

Use DuitNow QR to Scan & Pay, whether it's from Boost or other providers, for seamless in-store transactions.

Bill Payment & Prepaid Top Up

Effortlessly manage your bills and recharge your prepaid balance with Boost PayFlex to ensure a convenient payment experience for all your expenses.

How to Activate Boost PayFlex

Follow these simple steps to activate Boost PayFlex via the Boost app

Benefits of Boost PayFlex

Experience the convenience of flexible payment options, delivering your desires at your fingertips and simplifying payments for life's indulgences.

Take Control of Your Finances

Flexibility for you to take control to buy what you want now and pay for it later. You can also decide to pay in 30 days or make the repayment whenever you want, the choice is yours!

Use Boost PayFlex Anywhere

Enjoy unmatched convenience and flexibility for you shop first and pay later at more than 1.6 mil DuitNow QR stores nationwide.

Instant Approval With No Collaterals

Gain the peace of mind and convenience of swift approval without the need of any collateral, ensuring a hassle-free process for you.

Shariah Compliant

Empower yourself with the ability to make purchases now and pay for it later, all while adhering to the principles of Islamic finance.

Privacy and Security Are Our Top Priority

Ensure the Safety of Your Private Information By using Boost PayFlex, you can lessen the risk of fraudulent transactions associated with entering sensitive information.

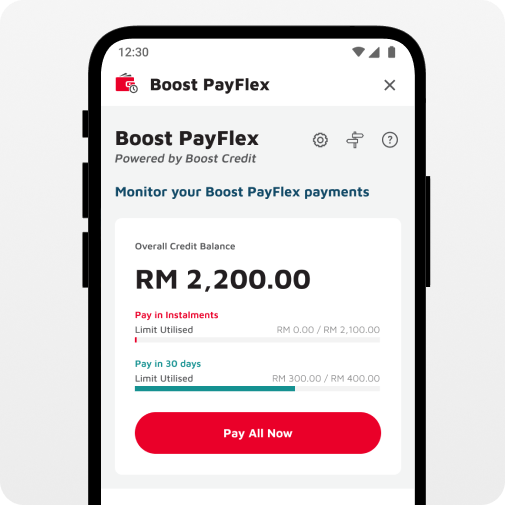

3 Easy Steps to Make Boost PayFlex Repayment

Follow these simple steps to make your repayment!

Boost PayFlex Eligibility

To benefit from this feature, you need to fulfill the criteria for eligibility:

Malaysian

A Malaysian Citizen with an active transaction history with Boost within the last 3 months.

Foreigner

A Foreign Citizen with an active transaction history with Credit Card within the last 6 months

Boost Premium

Upgrade to a Boost Premium account by verifying your details

Age

Aged between 21 – 60 years old

Tutorial Video

We will guide you step by step

Frequently Asked Questions (FAQs)

Question About Product Info

- Boost PayFlex (formerly known as Boost PayLater) is a digital payment solution provided by Boost Credit (formerly known as Aspirasi) in collaboration with participating partners and/or merchants that enable you to purchase Shariah compliant goods and/or services offered by merchants and to obtain an Islamic financing facility that enable you to finance your purchases and this is made via the Boost PayFlex facility available on Axiata Digital eCode Sdn Bhd’s (Company No: 201701000820 (1214970-T) (“Boost Life”) (“Merchant”) e-Wallet platform for the purchase via instalment(s) (only applicable for the services listed in Table 1).

- Please refer to the relevant Terms and Conditions for more information on the Boost PayFlex offerings.

- Boost PayFlex is based on the concept of Commodity Murabahah and is certified Shariah Compliant as approved by our Shariah advisors.

- If you are eligible for Boost PayFlex, you will be assigned with a credit limit which may vary for different customers. Please refer to the subsequent question on how the credit limit works.

- You will be able to draw down your PayFlex limit to make your payments/transactions at our accepted PayFlex touchpoints.

• PayFlex may be done using Pay in 30 days which allows you to transact today, and make repayment in 30 days; or 6 Month Instalment which allows you to transact today and split your payments into 6 instalments

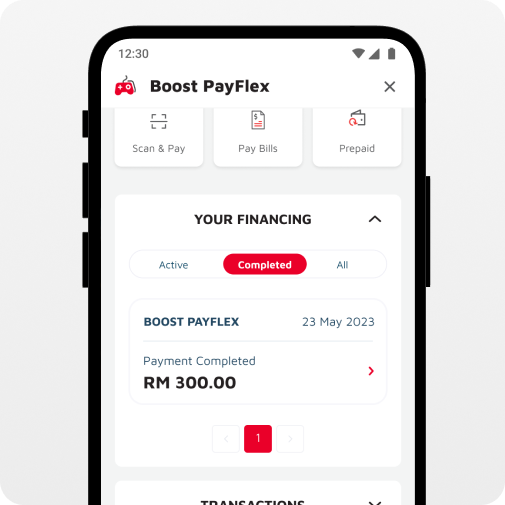

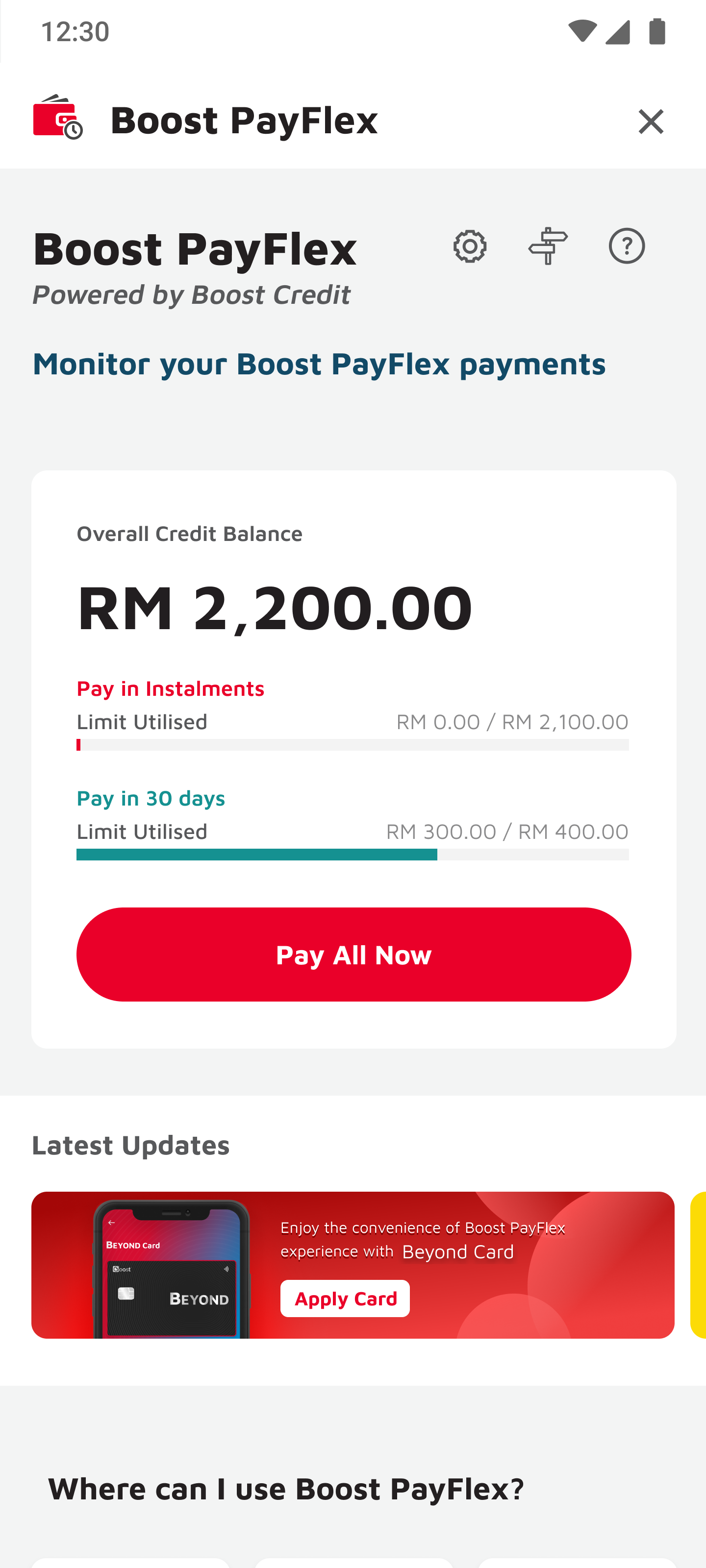

• The offerings and options may vary for different touchpoints/merchants/partners subject to our negotiation. - Thereafter, you can monitor your payments, repayment details, and all details pertaining your PayFlex transaction(s) in the Boost PayFlex dashboard in your Boost App.

- You will make repayment according to the due dates of your PayFlex transactions.

- Please refer to the relevant Terms and Conditions for more information on the Boost PayFlex offerings.

Boost PayFlex is a versatile payment solution that can be used for various transactions.

Refer to Table 1 in the FAQ below for a list of Billers and Telco Providers within the Boost App that accept PayFlex.

- Scan and Pay:

- Scan and pay at any DuitNow QR or Boost QR merchant nationwide.

- Enjoy flexible payment terms of up to 6 months instalments!

- The newly introduced "Add Money" feature now allows you to use Boost PayFlex even when the merchant scans your Boost QR code.

- Bill Payment: Settle your utility bills, and other recurring expenses conveniently using Boost PayFlex.

- Prepaid Telco Top-Ups: Recharge your prepaid mobile phone or internet plan with Boost PayFlex and spread the cost over time.

- Telco Postpaid Payments: Make your postpaid mobile or internet bill payments seamlessly with Boost PayFlex.

- Beyond Card: Elevate your Boost PayFlex experience with the Beyond Card, a seamlessly integrated prepaid Mastercard that grants you the flexibility to spread your payments over up to 6 months installments. Use the Beyond Card to make payments at any Mastercard touchpoint worldwide, including online stores, offline stores, and more.

- The limits are assigned based on your profile and information that we know of you and cannot be manually adjusted by request. However, the limits is subject to change from time to time.

- You may however make repayment for your existing PayFlex contracts within the Boost App. After repaying a contract, the said limit amount will be replenished and you’ll be able to transact again.

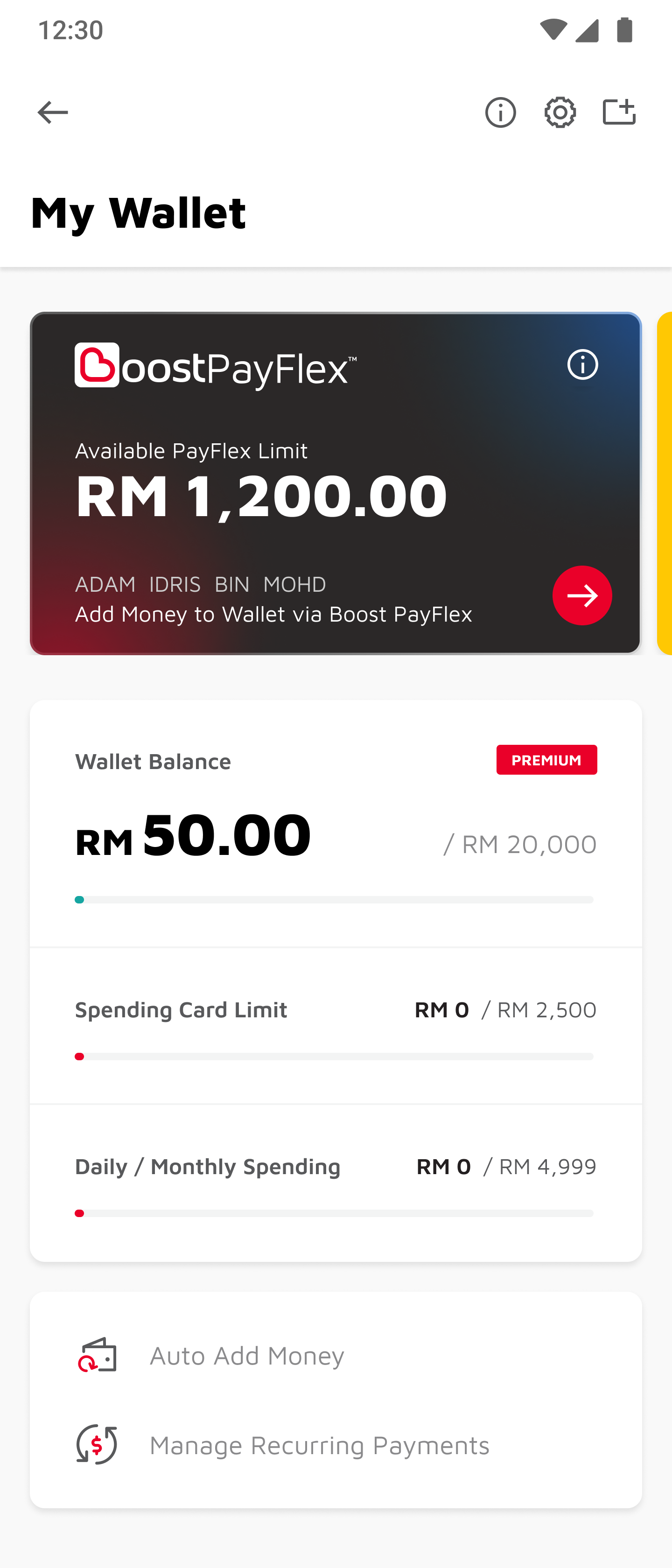

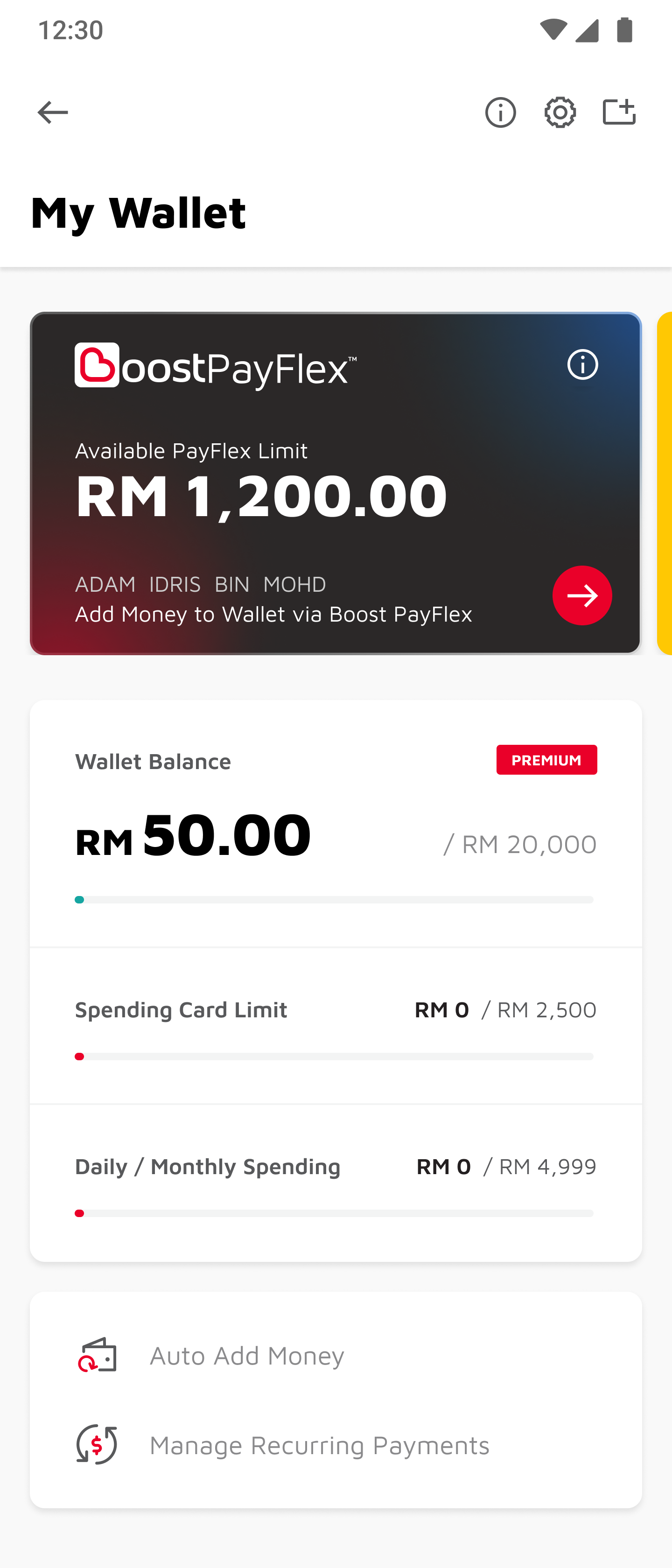

- On top of the existing method of using Online Banking or Debit/Credit Card to add money to your Boost Wallet, you can now use Boost PayFlex to add money to your Wallet!

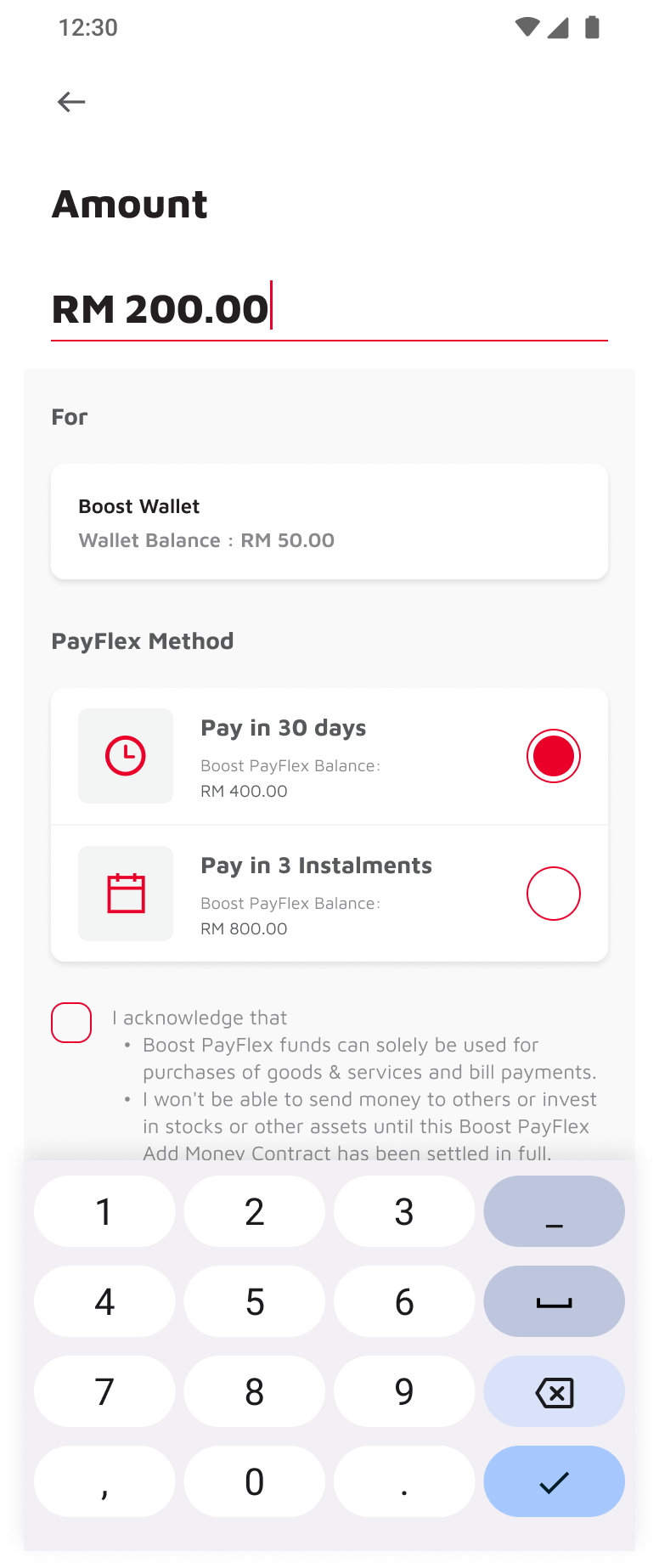

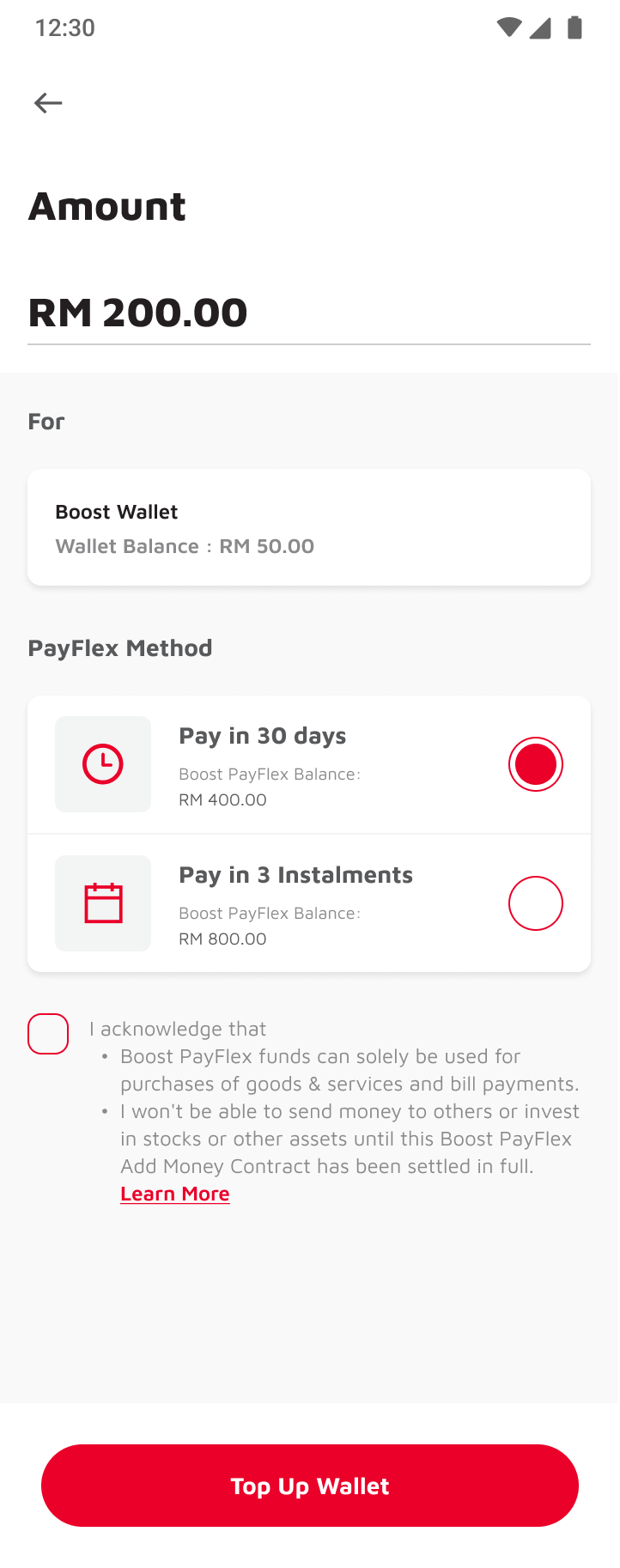

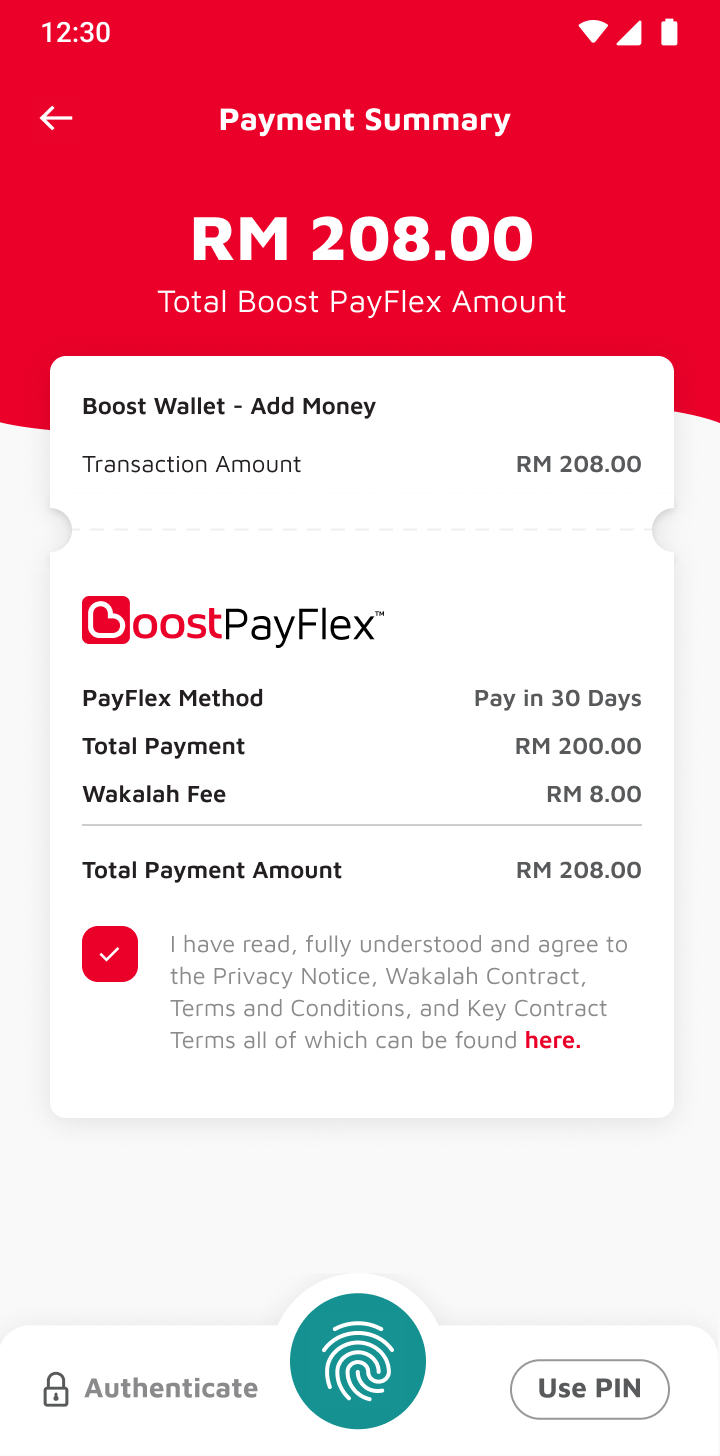

Add Money via Pay in 30 Days

Step 1: User launch the Boost Life app and taps on Wallet |  Step 2: User taps on Boost PayFlex Card |  Step 3: User enters Top Up amount |

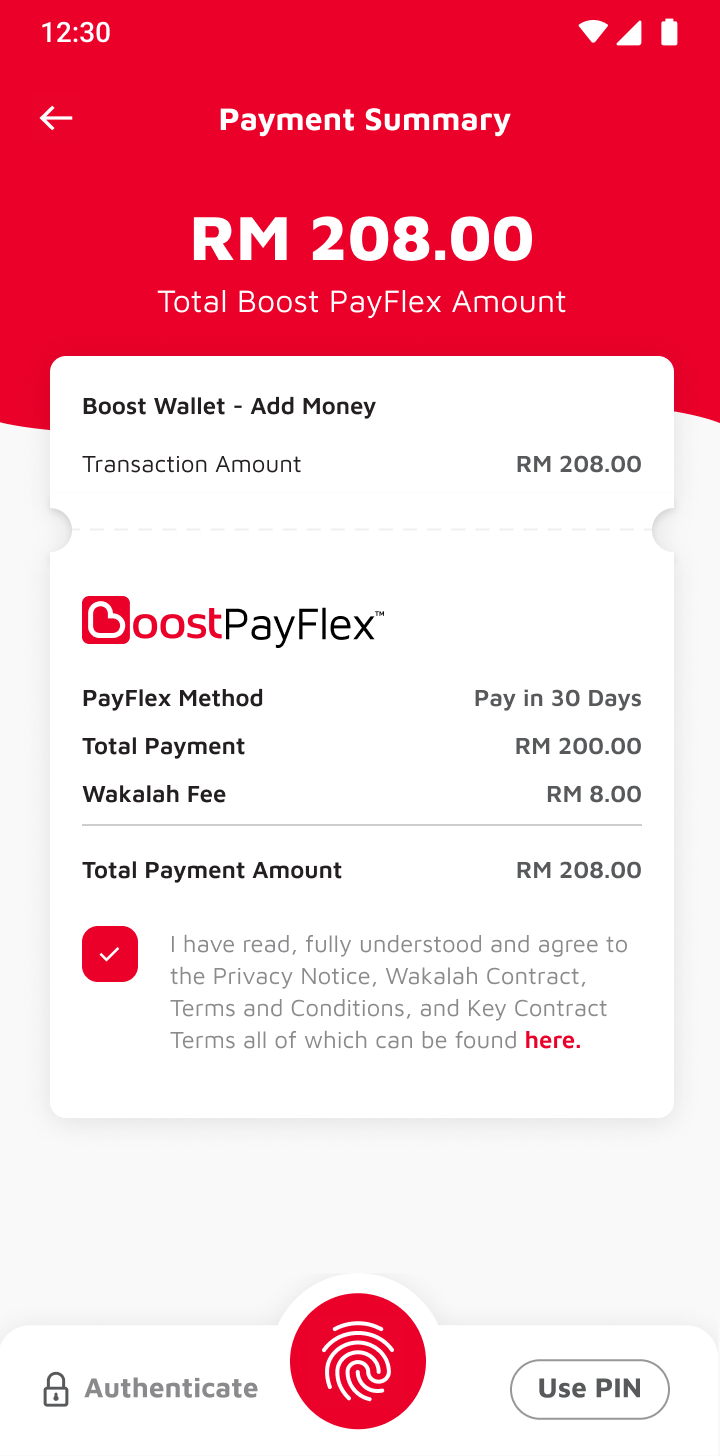

Step 4: User selects Pay in 30 Days PayFlex Method |  Step 5: User is required to authenticates and accepts T&C to proceed |

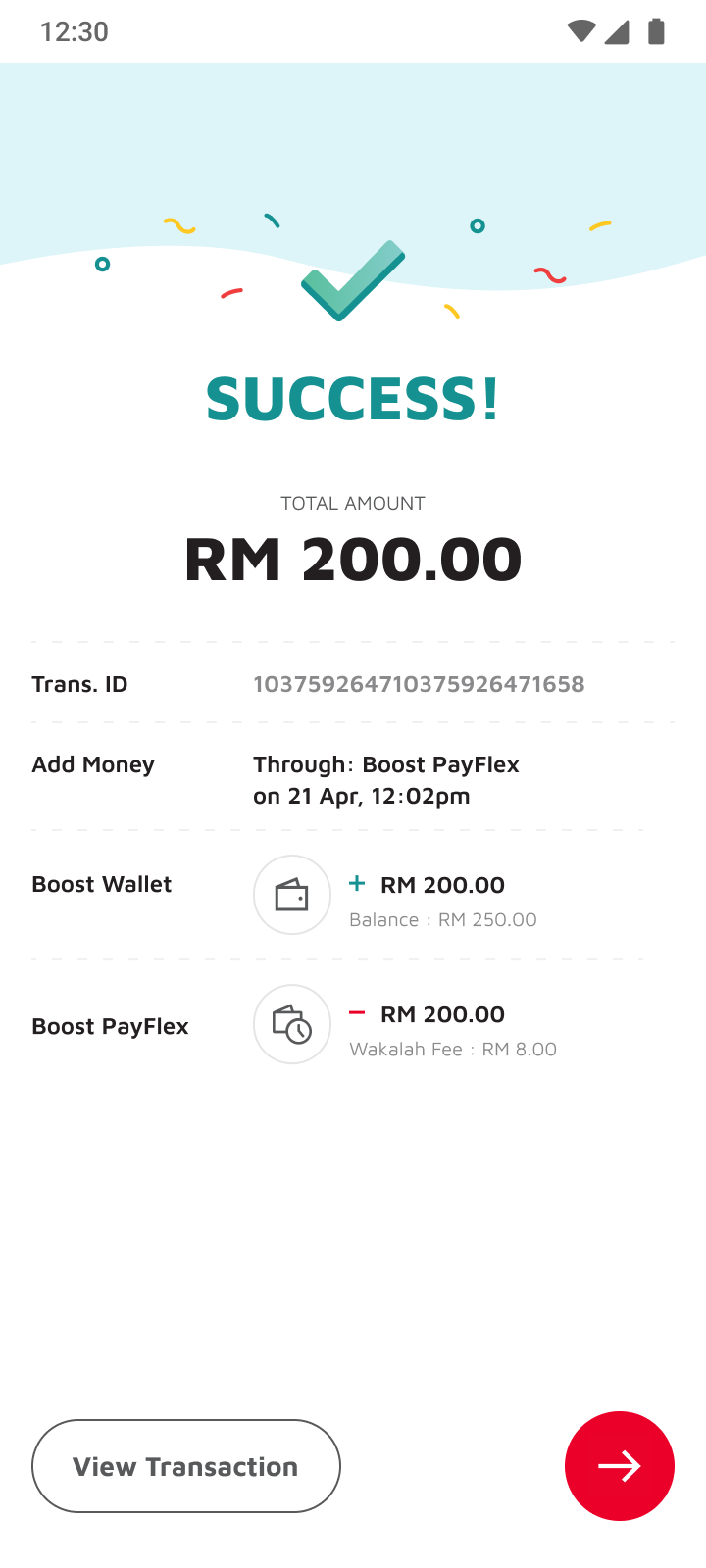

|  Step 6: User successfully Add Money to Boost Wallet |

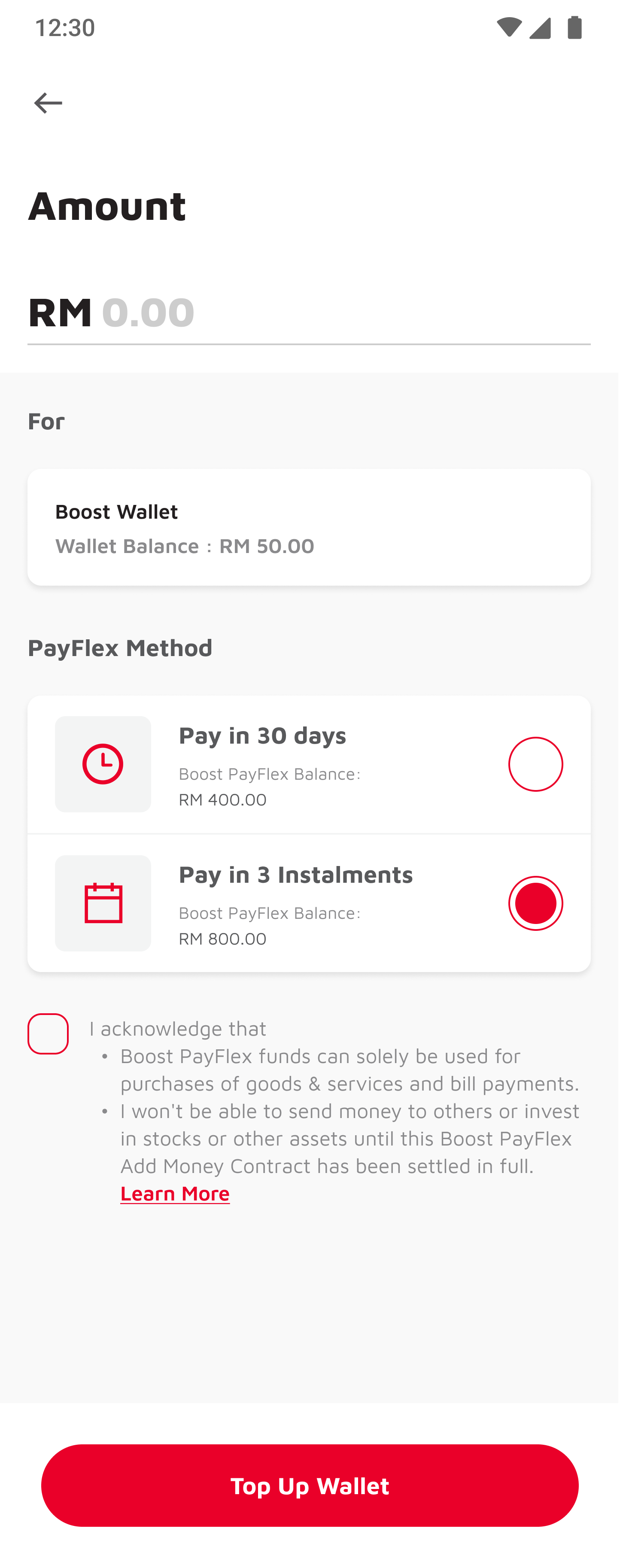

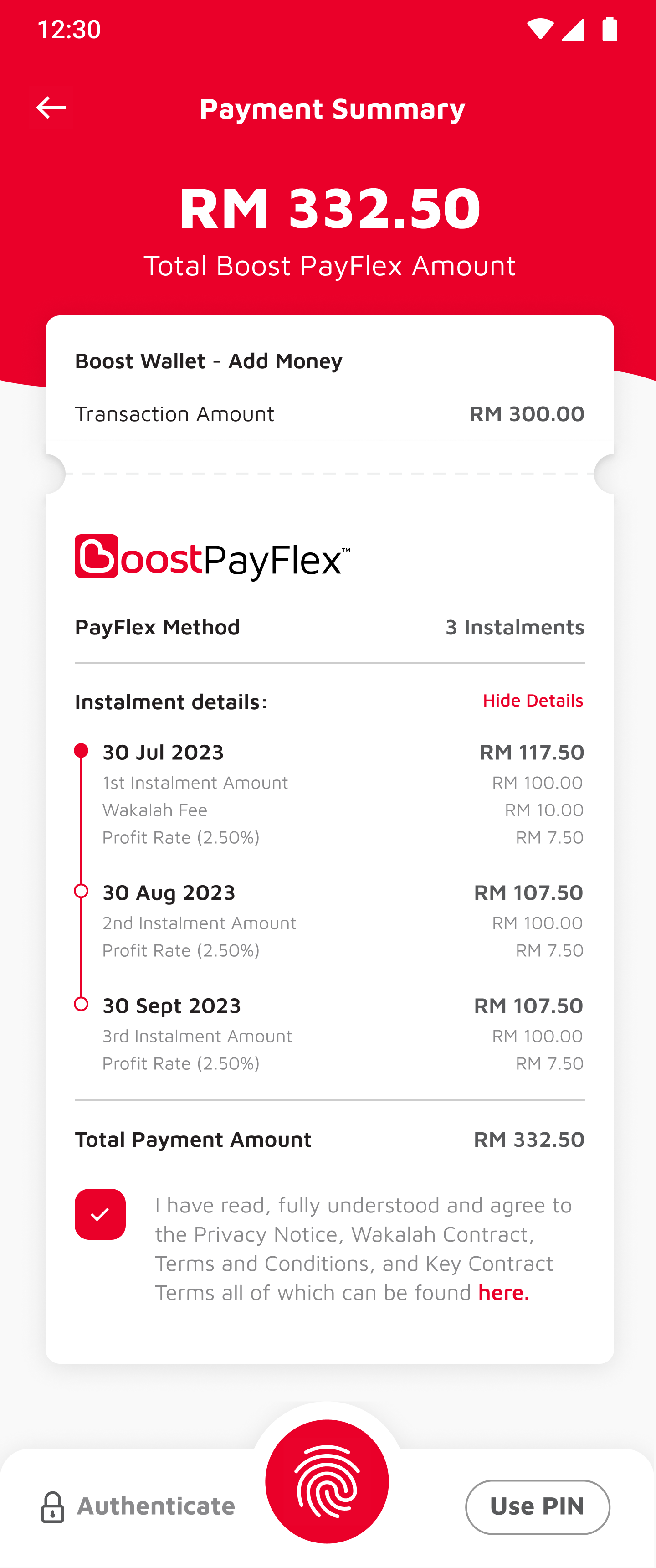

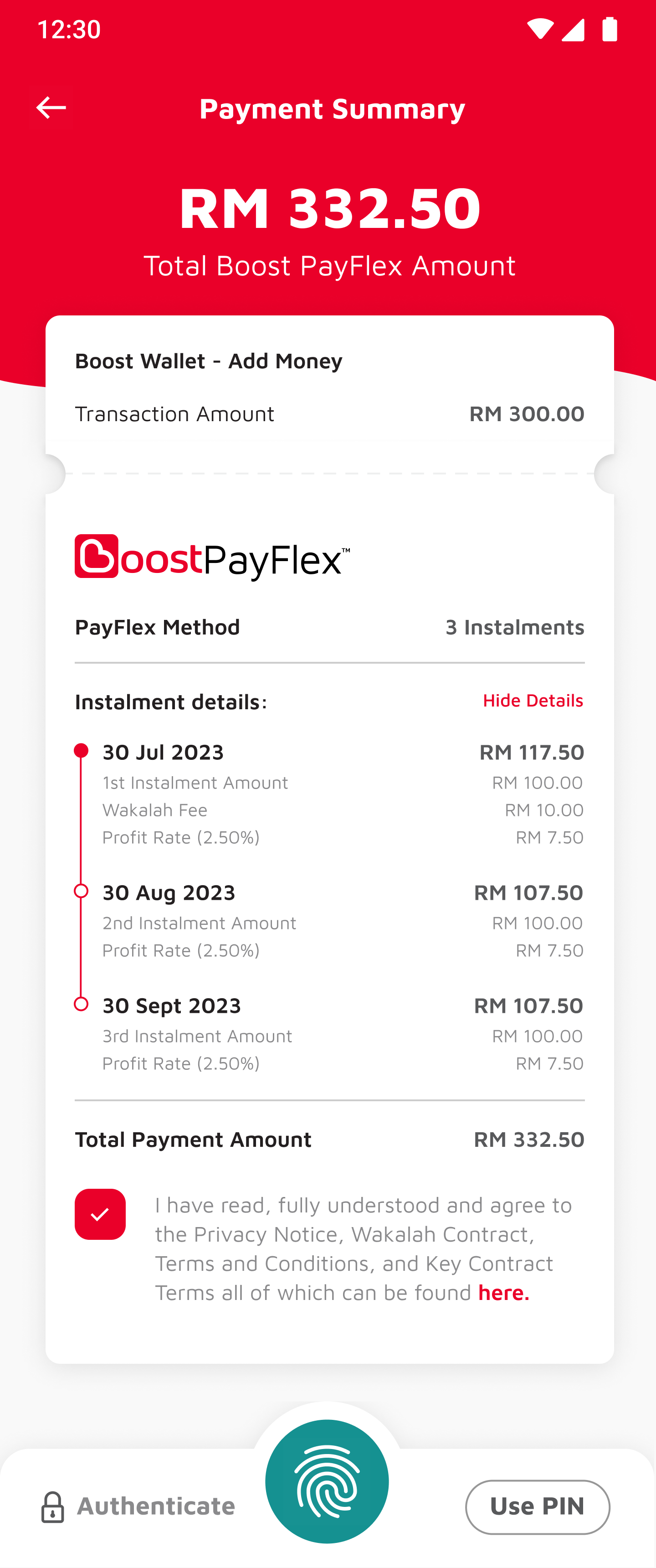

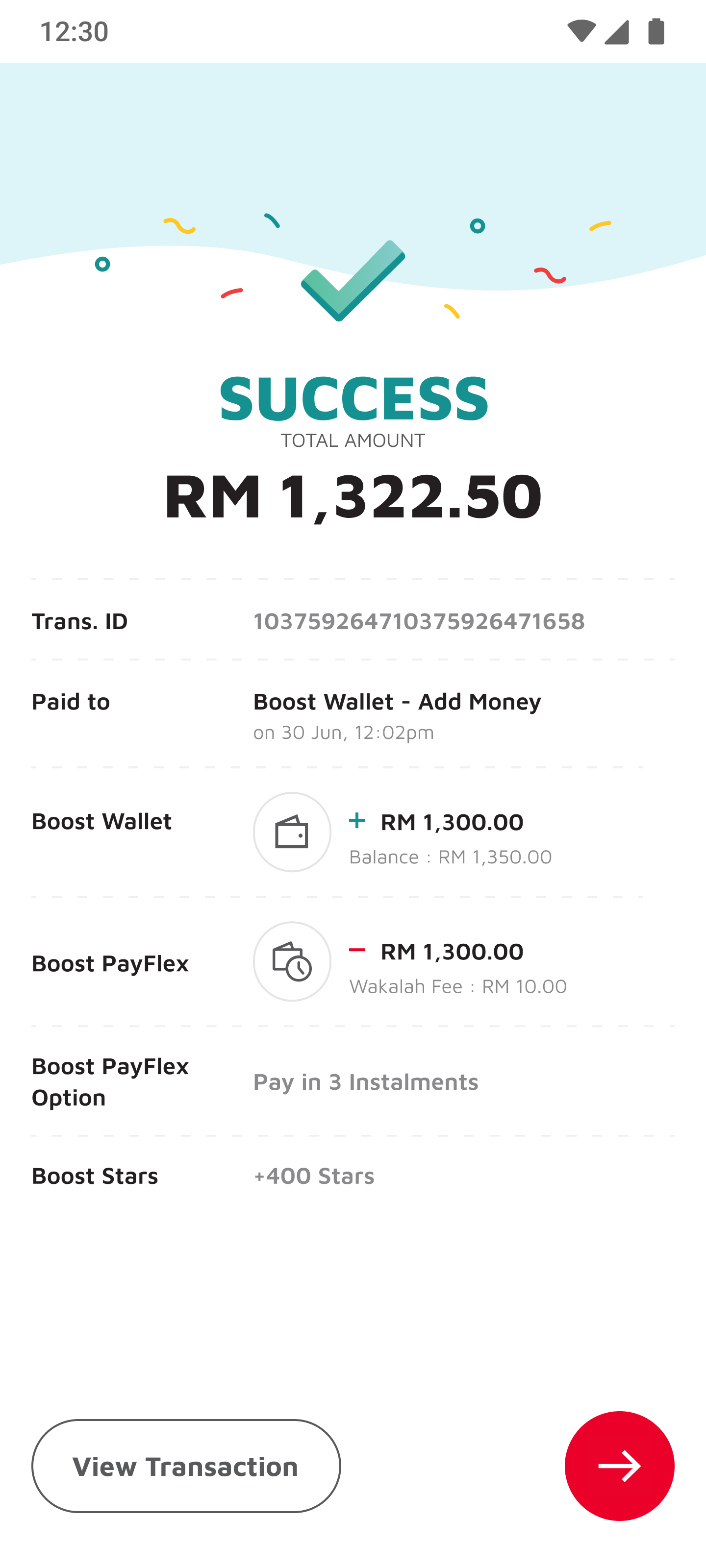

Add Money via 3 Instalments

Step 1: User launch the Boost Life app and taps on Wallet |  Step 2: User taps on Boost PayFlex Card |  Step 3: User enters Top Up amount & selects Pay in Instalments PayFlex Method |

Step 5: User is required to authenticates and accepts T&C to proceed |

|  Step 6: User successfully Add Money to Boost Wallet |

- Money added to your Boost Wallet using Boost PayFlex can be used for a wide range of purchases and bill payments, including:

- Scan and Pay at any DuitNow QR or Boost QR merchant nationwide

- Bill payments for utilities, internet, and other services

- Prepaid and postpaid telco reloads

- Beyond Card to make payments at any Mastercard touchpoint worldwide when your source of funds is set as “Boost Wallet”

- Please note that once you've added money using Boost PayFlex to your Wallet, you will temporarily be unable to make DuitNow transfers, P2P transfers, and investment payments. This restriction is in place to prevent misuse of funds until the PayFlex contract is repaid.

- Expanded Payment Options: Boost PayFlex extends your payment options, allowing you to seamlessly top up your Boost Wallet and make payments both online and in-store.

- Enhanced Purchasing Flexibility: Boost PayFlex empowers you with greater control over your finances, enabling you to plan your purchases in advance, add funds to your Boost Wallet using Boost PayFlex, and proceed to purchase your desired items at the respective stores!

If you have added money to your Wallet using Boost PayFlex, you will not be allowed to make DuitNow transfer, P2P transfer and investment payments temporarily to prevent the misuse of funds until your Add Money PayFlex contract is repaid in full.

Once you repay your Add Money PayFlex contract, you can perform those transactions again!

1. Cruise on Auto-Pilot with your Linked Bank Account:

Prefer hands-free? No problem! If your contract is linked to a bank account, charges will automatically occur 3 days after your due date. Sit back, relax, and enjoy peace of mind knowing your payments are covered. To change your linked bank account, simply reach out to creditinfo@myboost.co.

Things to remember:

- Ensure you have sufficient funds in your account to cover the payment on the due date.

- Automatic deductions happen on working days, excluding weekends and public holidays. You will not be charged late payment fees should your repayment date fall on any of these exclusion days

2.Take the wheel with Boost Wallet:

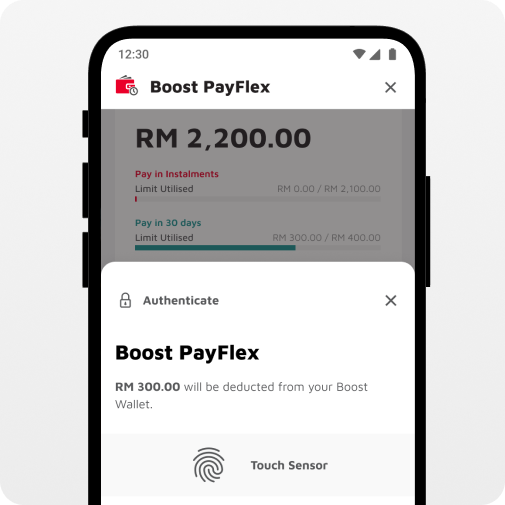

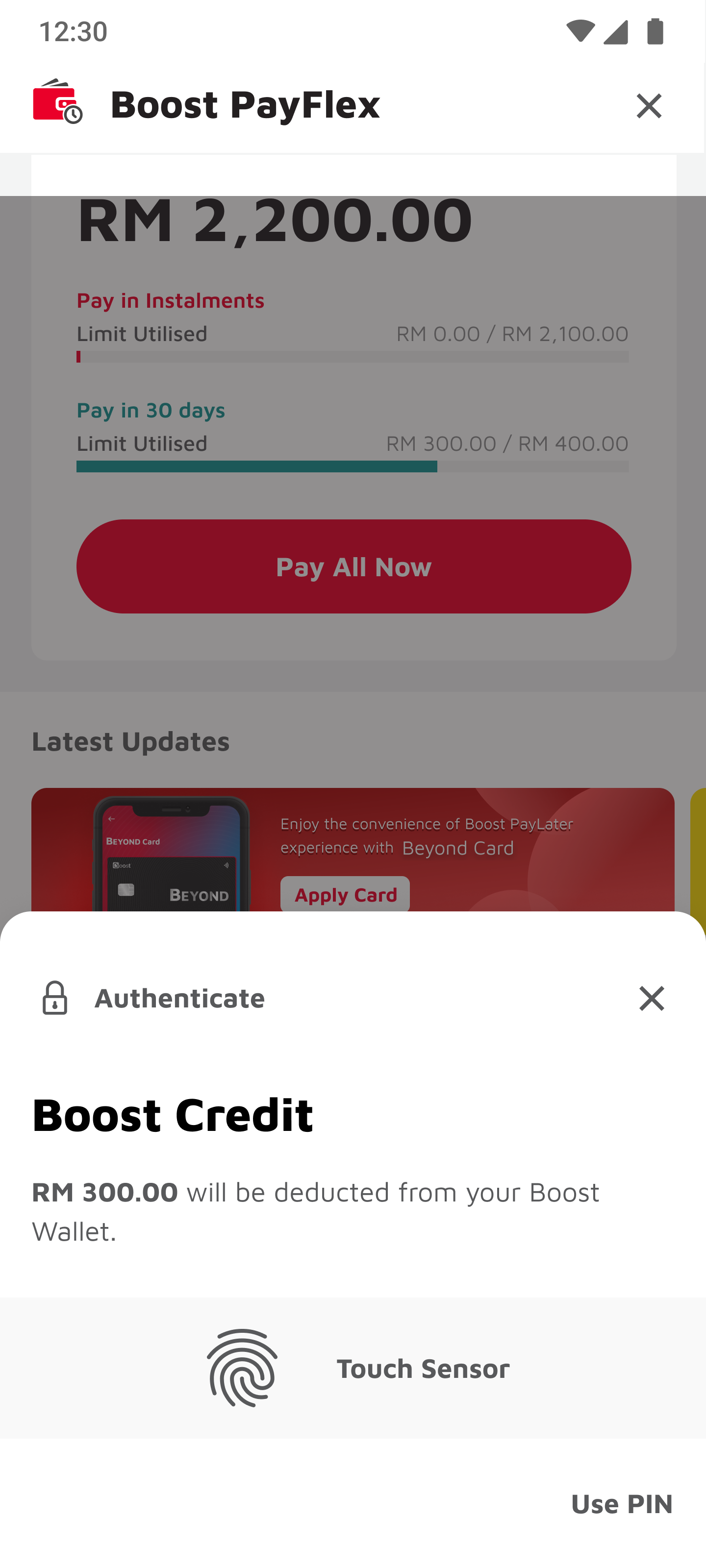

You can now manually repay your PayFlex contract up to 3 days past your due date, directly from your Boost Wallet! Just follow these simple steps:

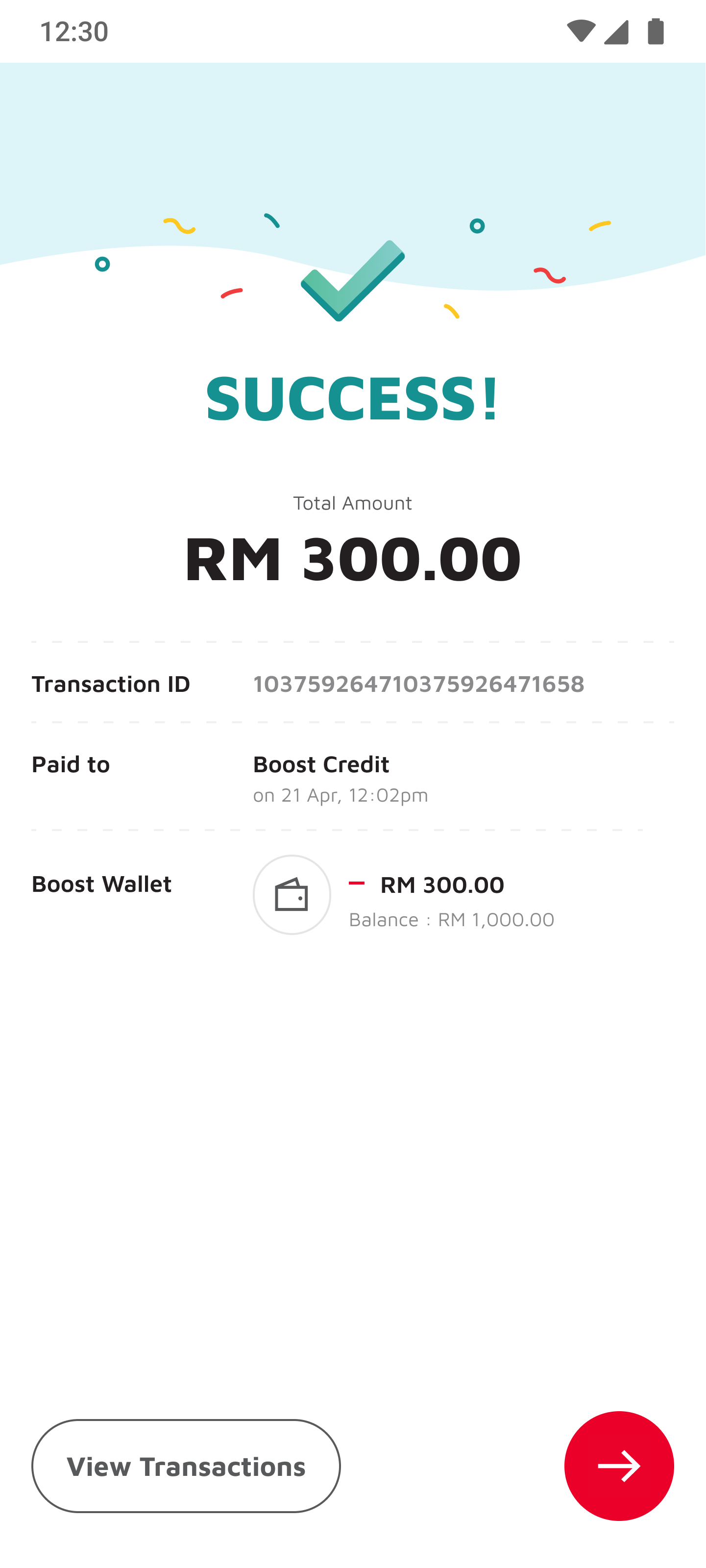

Step 1: Go to Boost PayFlex Dashboard and select to either Pay Now for a specific PayFlex contracts, or Pay All Now to settle all outstanding contracts. |  Step 2: Authenticate payment using Boost Wallet. |  Step 3: Tada! the select PayFlex contracts have been repaid. |

- The duration taken by each bank to process the auto debit may vary. Please note also that auto-deductions are made during working days, which excludes weekends and public holidays.

- It may take a few days from your due date to process the auto-debit from your linked bank account. Don't worry, you won't be charged with any fees within the 5 days after your due date.

- If your auto-debit isn't reflected after 5 days, please contact creditinfo@myboost.co. or you can pay via the Boost PayFlex Dashboard in the Boost app. Repayments will be done using your Boost Wallet.

You can use Boost PayFlex to pay your bills and telco with the following merchants on the Boost App.

| Category | Utilities |

| Mobile Prepaid | Celcom (Xpax) Prepaid Digi Prepaid Maxis (Hotlink) Prepaid MerchanTrade Preapid RedOne Prepaid TuneTalk Prepaid U Mobile Prepaid XOX Prepaid YES Prepaid |

| Mobile Postpais | Celcom Postpaid Digi Postpai RedOne Postpaid U Mobile Postpaid XOX Postpaid YES Postpaid |

| TV & Radio | Astro Bill |

| Electricity Utility | NUR Power Sabah Electricity Sarawak Energy Tenaga Nasional Berhad |

| Water Utility | Bekalan Air Labuan Indah Water Konsortium Lembaga Air Perak Pengurusan Air Pahang Berhad Syarikat Air Melaka Syarikat Air Perlis Syarikat Air Terengganu Syarikat Bekalan Air Selangor Air Kelantan Syarikat Air Darul Aman Syarikat Air Johor Syarikat Air Negeri Sembilan Perbadanan Bekalan Air Pulau Pinang Lembaga Air Kuching |

Question About Eligibility

i. Malaysian / Foreigner legally residing in Malaysia

ii. Aged 21 – 60

iii. Premium Boost App users (with good credit history) who may require monetary assistance to pay for services as listed in Table 1

- You are pre-scored based on Boost Credit’s eligibility requirements which may include but not limited to your spending trends on Boost App (e.g. amount spend, frequency of transactions), top up method, etc. and will be notified when eligible from time to time.

- Your Boost PayFlex available limit may vary from other customers and is assigned based on your profile, CCRIS assessment and information available and provided to Boost Credit.

- While there are some basic requirements to be eligible for Boost PayFlex, customers are still pre-scored based on a list of other internal conditions which may change from time to time.

- The list of eligible customers may be refreshed on a regular basis. Hang in there! We’ll notify you when you’re eligible.

Question About Payment

- Your PayFlex limit is the maximum amount that you are allowed to spend using PayFlex at a point in time at our accepted PayFlex touchpoints.

- The PayFlex limit is split into 2 portions: Pay in 30 days limit and Instalment limits.

• Pay in 30 days limit is the total portion that can be utilized only using Pay in 30 days method

• Instalment limit is the portion that can be utilized using Instalment method

• Note: Pay in 30 days and/or Instalment option may be offered for different touchpoints and use cases subject to our offering. - Credit limit assigned to customers may vary for different individuals.

- The auto-debit is performed based on the bank account and account number selected by you during your Boost PayFlex setup.

- If you’re unable to remember or would like to verify that bank account details linked, please email us at creditinfo@myboost.co to obtain the above information.

- You are required to make the relevant payments in accordance with the relevant Boost PayFlex offering.

- You can make payment via the Pay Now or Pay All Now features through the dashboard whereby payment will be deducted from your Boost e-Wallet or the payment will be deducted via direct debit during the payment due date.

- You should always have a sufficient sum of balance in your account for the direct debit mandate for the payment.

- Kindly note, during the deduction via direct debit, the Pay Now or Pay All Now features will be disabled to avoid double payments.

- Do contact Boost Credit if you foresee difficulties in making repayments, please email Boost Credit at creditinfo@myboost.co before the repayment due date(s) so that Boost Credit can provide the assistance you may require. Until a solution is achieved and agreed in writing by the parties, your obligation to make prompt payments on the due date(s) continues, failing which, you will incur such late payment charges accordingly.

Please refer here for the Fees & Charges.

- Depending at which phase you are in your payment, relevant late payment charges will be charged on such outstanding amount.

- If you are unable to meet your repayment obligations on the due date(s), you will incur the applicable late payment charges imposed accordingly on your outstanding amount. Boost Credit will commence legal action against you for the recovery of all payments due as well as the enforcement of all rights afforded to Boost Credit under the relevant Terms and Conditions and the relevant laws without further notice to you, where you shall be further liable for the costs occasioned thereof. Kindly also note that it is within our rights under the relevant Terms and Conditions to disclose all information set out to credit information organisations or other authority or body established by Bank Negara Malaysia, credit reporting agencies and any other authority having jurisdiction over Boost Credit, and it may limit your ability to obtain any loan or financing facility in the future from a commercial bank or a financial institution in Malaysia.

- You can settle your outstanding amount by clicking on the Pay Now feature on Boost PayFlex Dashboard in the Boost app.

Question About Support

- No guarantor or collateral is required.

- Please email us at creditinfo@myboost.co for more information

BOOST APP

Take control of your payments with the Boost App.

Enjoy the flexibility to stretch your payments, buy now and pay later with Boost PayFlex at more than 1.6 mil DuitNow QR nationwide.