Qualifying for a business loan from traditional financial institutions can be a challenge especially when you don’t have credit history or certain collaterals This is especially tough for nano- and micro-business owners as there are multiple tedious documentation with unfamiliar language to prepare, which can come across as intimidating. Also, depending on the amount needed for the loan, it’s not a guarantee that your application will be successful.

This is where micro-financing comes in.

What is micro-financing?

Micro-financing are loans given in small amounts with relatively short repayment periods of 12-18 months that requires little or no collateral. Typically offered to MSME’s and underserved segments that can include sole proprietors or micro-enterprises who may have little or no access to financial services or options from regular financial institutions.

Over the years, micro-financing has risen in popularity, especially in the past two years, with more fintech companies like Boost offering help for MSMEs to stay afloat during the pandemic phase, serving as a new cashflow lifeline.

Beyond a lifeline, it can be used as an essential fund for running day-to-day operations or grow a business. Additionally, it is a legitimate and safer alternative from resorting to illegal money lenders.

Capital by Boost Credit

Boost Credit, is our AI- based lending business which offers a Shariah-compliant micro-financing facility based on Commodity Murabahah called ‘Capital’. Through Capital by Boost Credit, MSMEs can obtain financing from as low as RM1,000 and up to RM100,000 over a tenure of 12-months at a low profit rate of 1.5% per month. MSMEs do not need any guarantor or collaterals to apply for this financing.

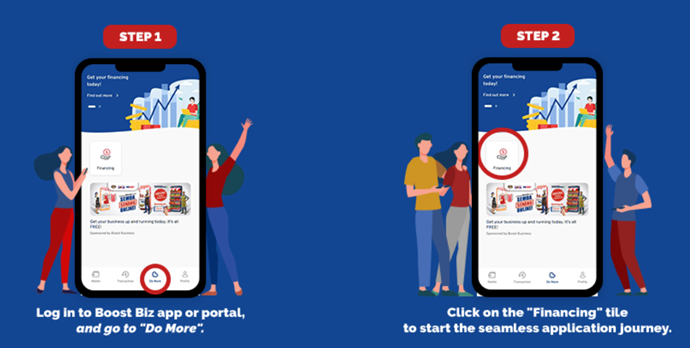

The application process is easy, fully digital and can be done in under 10 minutes, in which the funds will be disbursed within 48 hours (2 working days) directly into their bank account upon approval.

Capital is open to all micro-enterprises including Boost Biz merchants, where they can apply directly from the app, whereas non-Boost Biz merchants can apply online here.

To apply for Capital by Boost Credit, all you need to provide is:

- Your Full Name as per NRIC

- Your Business Name, Business Registration Number and Business Category as per registered with SSM

- Access to a camera feature (either with laptop or mobile device) for verification purposes

- Your latest 6 months company bank account e-statements.

For Boost Biz merchants, Boost Credit will utilize transaction history and convert it to an alternative credit score to assess creditworthiness. This will then determine how much loan a merchant is qualify for and the repayment amount.

For more information on Capital by Boost Credit, please visit https://www.myboost.com.my/business/features/capital-by-boost-credit/

To apply for Capital by Boost Credit, please click here.

Interested to be a Boost merchant, please click here.